Texas Workers’ Compensation Benefits: What You’re Entitled To

If you’ve suffered an injury on the job in Texas, the workers’ compensation system exists to help you recover physically and financially. Workers’ compensation provides various benefits to injured employees, including medical treatment, wage replacement, and long-term financial support for severe injuries. However, understanding the full scope of these Texas workers compensation benefits is essential to ensure you receive everything you’re entitled to under the law.

This guide will break down the key benefits available, explain eligibility requirements, and highlight common challenges workers face when navigating Texas workers compensation law.

Medical Workers’ Comp Benefits

The foundation of any workers’ compensation claim is medical coverage, which ensures that injured workers have access to necessary care without incurring personal costs.

What’s Covered Under Medical Benefits?

Under Texas workers’ comp, employees are entitled to all medical care deemed reasonable and necessary to treat their work-related injury. This can include:

- Doctor’s visits: Appointments for evaluation, treatment, or follow-up.

- Hospital stays: Inpatient and outpatient care, including surgeries.

- Prescriptions and medication: Any drugs prescribed to manage pain or aid recovery.

- Rehabilitation services: Physical therapy, occupational therapy, or specialized treatments to restore function.

- Specialist visits: Consultations with specialists for injuries requiring expert care.

Workers may also qualify for reimbursement for medical travel expenses, such as mileage for trips to and from appointments.

How Do I Know If My Employer Has Workers’ Compensation Insurance?

In Texas, it’s essential to know if your employer has workers compensation insurance to understand your options in case of a work-related injury. Texas law doesn’t mandate workers compensation coverage for all employers, meaning some companies don’t carry workers comp. Here’s how to find out if your employer has coverage:

- Ask Directly: Speak with your employer or HR department to confirm if they participate in the workers compensation program.

- Check with the Texas Department of Insurance (TDI): TDI offers resources to verify employers’ workers comp coverage status.

- Confirm with the Employer’s Insurance Company: If your employer has coverage, you can contact their insurance carrier to confirm.

Knowing if your employer has workers compensation coverage will guide your next steps. For non-subscriber employers (those who opt out of the system), Dallas workers compensation lawyers can help you pursue compensation directly through a personal injury claim.

Limitations on Medical Benefits

While coverage is broad, treatments must be approved by the treating doctor, who ensures they are necessary and fall within the approved medical guidelines. In some cases, disputes may arise if an employer or insurer questions the validity of the recommended care.

Temporary Income Benefits in Texas: How Much You Can Expect

When an injury prevents you from working, you may qualify to receive benefits in the form of temporary income benefits (TIBs) to replace a portion of your lost wages. These benefits are critical for injured employees who are temporarily unable to earn their pre-injury income.

What Are Temporary Income Benefits?

TIBs are designed to replace lost wages while an injured worker recovers. These payments begin after a worker has been unable to work for more than seven days due to their injury.

How Are Temporary Income Benefits Calculated?

TIBs are calculated as 70% of the worker’s average weekly wage (AWW) for most employees. For those earning less than $10/hour, the benefits may equal 75% of their AWW for the first 26 weeks. However, these benefits are subject to the Texas workers compensation maximum benefits cap, which changes annually.

Duration of Temporary Income Benefits

TIBs continue until one of the following occurs:

- The worker returns to their job.

- The worker reaches Maximum Medical Improvement (MMI)—the point where further recovery is unlikely.

- The worker receives TIBs for 104 weeks.

If your TIBs are delayed, reduced, or denied, legal assistance may be necessary to challenge the insurer’s decision.

How Much Are Temporary Income Benefits in Texas?

The exact amount you can receive depends on your average weekly wage. Here’s how it works:

- Calculation: 70% (or 75%) of your AWW, capped by the state’s maximum benefit rate.

- Example: If your AWW is $1,000, and the state maximum is $900, your weekly benefit will be $700. However, if your AWW exceeds the cap, your payment will be limited to the state’s maximum allowable rate.

Pro Tip: Always verify your AWW calculation to ensure you’re receiving the correct amount. Errors in this calculation can significantly affect your benefits.

Texas Workers’ Comp: How Much Are Supplemental Income Benefits?

Once temporary income benefits expire, workers with lasting impairments that limit their earning potential may qualify for supplemental income benefits (SIBs). These benefits help bridge the financial gap for workers who can no longer earn their pre-injury wages.

What Are Supplemental Income Benefits?

SIBs provide ongoing financial support for workers whose injuries result in permanent impairment. To qualify, you must:

- Have a permanent impairment rating of at least 15%.

- Demonstrate a good-faith effort to find suitable work or participate in a vocational rehabilitation program.

- File quarterly applications showing proof of your job search and earnings.

How Are Supplemental Income Benefits Calculated?

SIBs are calculated as 80% of the difference between your pre-injury wages and post-injury wages. For example, if you earned $1,000 per week before your injury but now only earn $400, your SIBs would be 80% of $600, or $480 per week.

Lifetime Income Benefits for Total Disability

Lifetime income benefits (LIBs) are reserved for workers who sustain catastrophic injuries that prevent them from ever working again. These benefits provide lifelong financial stability.

Who Qualifies for Lifetime Income Benefits?

To qualify for LIBs, you must have a severe injury, such as:

- Permanent loss of use of both hands, feet, eyes, or a combination of these.

- Paralysis of two or more limbs.

- Severe traumatic brain injuries causing permanent cognitive impairment.

How Are Lifetime Income Benefits Paid?

LIBs are calculated as 75% of the worker’s pre-injury wages. Each year, the payments are adjusted with a 3% increase to account for inflation. These benefits provide lifelong financial security for the most severely injured workers.

Other Workers’ Comp Benefits in Texas

In addition to wage replacement and medical care, the Texas workers compensation system provides several other benefits:

Workers compensation insurance is essential for providing benefits to employees who suffer work-related injuries or illnesses, protecting both employees and employers from legal costs.

Vocational Rehabilitation

If you cannot return to your previous job due to your injury, vocational rehabilitation services can help you transition to a new career. These services include retraining, job placement assistance, and education programs to develop new skills.

Death Benefits for Dependents

If a worker dies due to a workplace injury or illness, their dependents may be entitled to death benefits. These benefits provide:

- Wage replacement for surviving family members, typically 75% of the deceased worker’s AWW.

- Reimbursement for funeral expenses, up to a set limit.

Medical Travel Reimbursement

Workers may also be reimbursed for travel expenses incurred while seeking medical treatment, such as mileage for trips to appointments or specialists.

Impairment Income Benefits (IIBs) in Texas: What You Need to Know

When a worker reaches Maximum Medical Improvement (MMI) but still has a permanent impairment, they may qualify for impairment income benefits (IIBs). These benefits compensate for the lasting impact of the injury.

How Are Impairment Ratings Determined?

After reaching MMI, a medical evaluation determines your impairment rating, which reflects the severity of your permanent injury. This rating is expressed as a percentage.

- For every 1% of impairment, you’re entitled to 3 weeks of IIB payments.

- If your impairment rating is 10%, you’ll receive 30 weeks of IIBs, paid at 70% of your AWW.

IIBs provide critical financial support for workers adjusting to long-term limitations caused by their injuries.

Limitations of Workers’ Comp Benefits in Texas

The workers comp system in Texas offers significant support, but there are limitations:

- Maximum Benefit Caps: Benefits are subject to state-imposed limits, which may not fully cover lost wages for high earners.

- Time Limits: Benefits such as TIBs and IIBs are temporary, and payments stop once the maximum duration is reached.

- Disputes: Employers or insurers may challenge the severity of your injury, delaying or reducing benefits.

Understanding your legal rights and the appeals process is critical if you encounter issues with your claim.

Texas Workers’ Compensation Laws: What You Need to Know

The Texas Department of Insurance Division of Workers’ Compensation (TDI-DWC) regulates the state’s workers’ compensation program. Key points to know include:

- No Mandatory Coverage: Unlike most states, Texas does not require employers to carry workers’ comp insurance. However, employers who opt out may face lawsuits for workplace injuries.

- Reporting Requirements: Workers must report injuries to their employer within 30 days and file claims within 1 year.

- Dispute Resolution: The TDI-DWC provides mediation and hearings to resolve disputes between workers and insurers.

Conclusion

Texas workers’ compensation benefits are designed to protect injured employees by covering medical treatment, replacing lost wages, and providing long-term support for severe injuries. Understanding your rights to benefits like temporary income benefits, impairment income benefits, and lifetime income benefits is crucial to ensuring fair compensation.

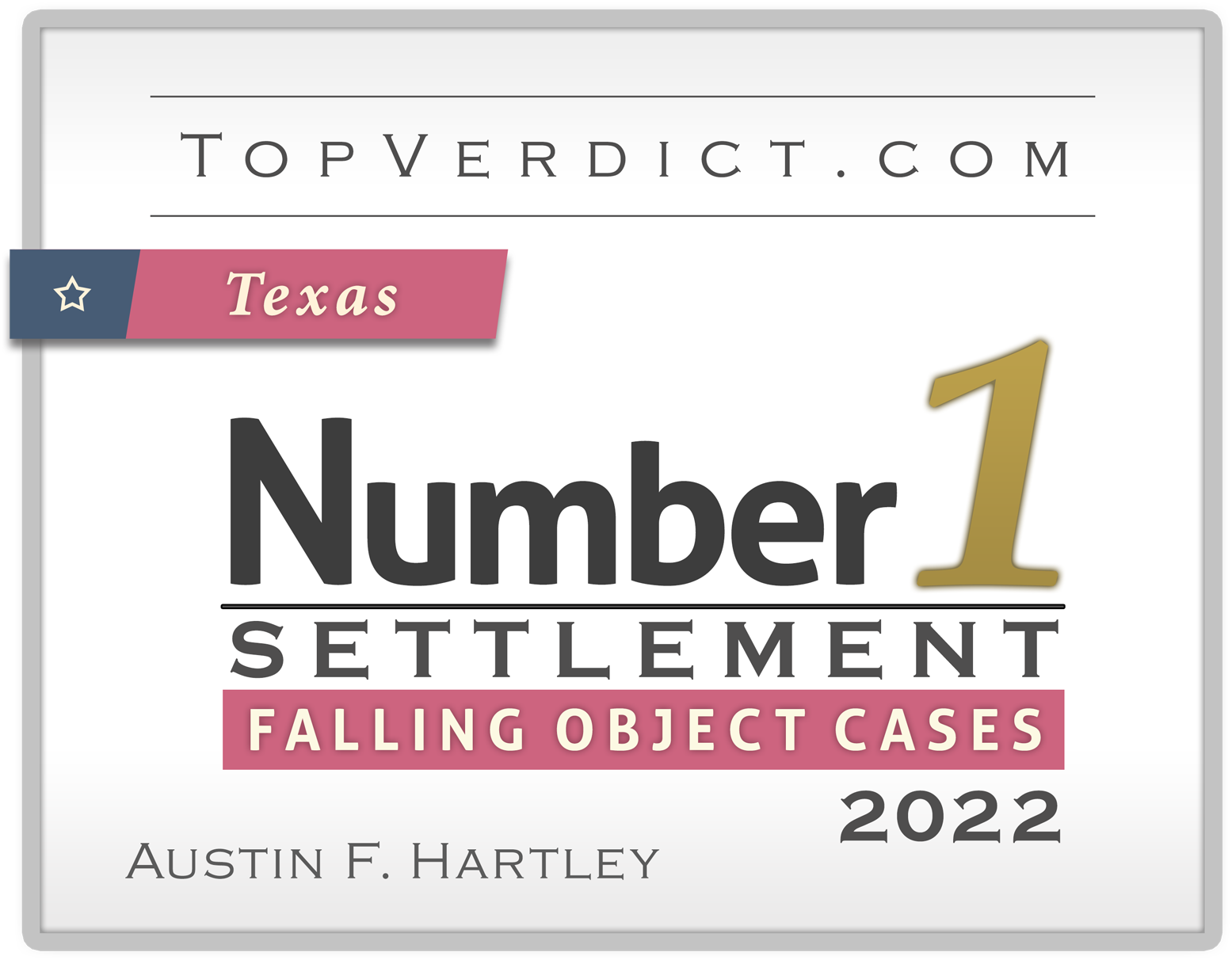

If you’re navigating the workers compensation system and need help, Hartley Law is here to assist. With years of experience advocating for injured workers, we’ll ensure your rights are protected.

For more information or to schedule a free consultation, visit our pages on Dallas Personal Injury Services, Dallas Car Accident Services, and Dallas Truck Accident Services.